Wage Garnishment? We can stop that!

Bankruptcy immediately ends most wage garnishments

If you have ever had an involuntary wage garnishment, you know that it can put a huge stress on being able to pay for everyday living expenses. A wage garnishment can be a detrimental and embarrassing event - but bankruptcy, in many cases, can put an immediate end to it and provide a fresh financial start.

What is a garnishment?

An involuntary wage garnishment in Indiana is a legal means of attaching to the wages of a debtor to satisfy an unpaid debt. While some garnishments can be obtained administratively by law without a court order (i.e. garnishment for a student loan), most garnishments require a court order.

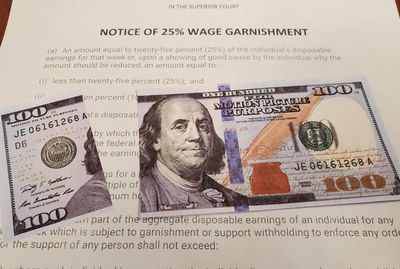

In Indiana, once a debt is reduced to judgment, the prevailing party, the "judgment-creditor," can seek a variety of means in proceedings supplemental to satisfy the judgment debt. The judgment-creditor can freeze your bank account, put a lien against your real estate, seize non-exempt assets and/or seek a wage garnishment. Under current Indiana and Federal laws, a wage garnishment can result in an attachment of up to 25% of net, or "take home," pay (more for child support obligations and federal tax liabilities).

Adding insult to injury, a garnishment not only makes a significant dent in your ability to support yourself and your family, but it also gets your employer involved in your financial affairs. A wage garnishment is initiated in Indiana by naming your employer as a party to the lawsuit - a "garnishee-defendant." The employer is served with "interrogatories" that ask about you, your pay, your withholdings, and that information is provided to the judgment creditor. The employer, or whoever handles payroll, is responsible for deducting the appropriate amount of wages from each and every paycheck and sending it to the judgment creditor as proscribed in the court's order.

How does bankruptcy stop garnishments?

When a bankruptcy petition is filed with the court, an "automatic stay" against collection effort goes into immediate effect. The automatic stay immediately stops further garnishment to satisfy dischargable debt.

It is important to file bankruptcy before wage garnishment begins because wages that are attached before the bankruptcy is filed are gone - you can't get them back. If wages are attached after the bankruptcy is filed, those wages can be returned to the extent that they are exempt.

As soon as a bankruptcy case is filed, Mr. Lewis sends a notice to the employer that the bankruptcy automatic stay prohibits further garnishment. The judgment creditor, upon learning of the bankruptcy filing, has an affirmative duty to inform the court and ask that the court order granting the garnishment be vacated. When a debtor receives a bankruptcy discharge, the creditor subject to discharge can never initiate any collection effort, including wage garnishment, ever again.

A 25% reduction in pay can be devastating

Stop the Bleeding! Wage garnishment in Indiana

Losing 25% of your paycheck can be devastating. Find out how to stop it.

More videos available here

Mr. Lewis has published many helpful videos to help you better understand the bankruptcy process

Bankruptcy Law Office of Eric C Lewis

Lewis Legal Services, P.C. P.O. Box 40603 Indianapolis, IN 46240 USA

Phone: 317.623.3030 Email: debtfreeindy@gmail.com

Lewis Legal Services, P.C. is a law firm and federal debt relief agency.

We help honest people file for relief under the U.S. bankruptcy code.

Copyright © 2025 Lewis Legal Services, P.C. - All Rights Reserved.